https://bitsharestalk.org/index.php?topic=29693.75 and following pages.

Can also check blockchain explorers or web wallets:

https://bts.ai/details/account/committee-trade

https://cryptofresh.com/u/committee-trade

https://wallet.bitshares.org/#/account/committee-trade

How to verify the reward data

1. run a patched https://github.com/abitmore/bitshares-core/tree/ugly-3.0

delayed node https://github.com/bitshares/bitshares-core/wiki/Delayed-Node

to generate snapshots (update "config.ini" as follows):

# Ugly snapshot start block number

ugly-snapshot-start-block = 42000000

# Ugly snapshot markets

ugly-snapshot-markets = [ ["1.3.0","1.3.861"], ["1.3.0","1.3.1570"], ["1.3.0","1.3.2241"],

["1.3.0","1.3.3926"], ["1.3.0","1.3.4157"], ["1.3.0","1.3.4198"], ["1.3.0","1.3.1042"],

["1.3.0","1.3.5144"], ["1.3.0","1.3.5286"] ]

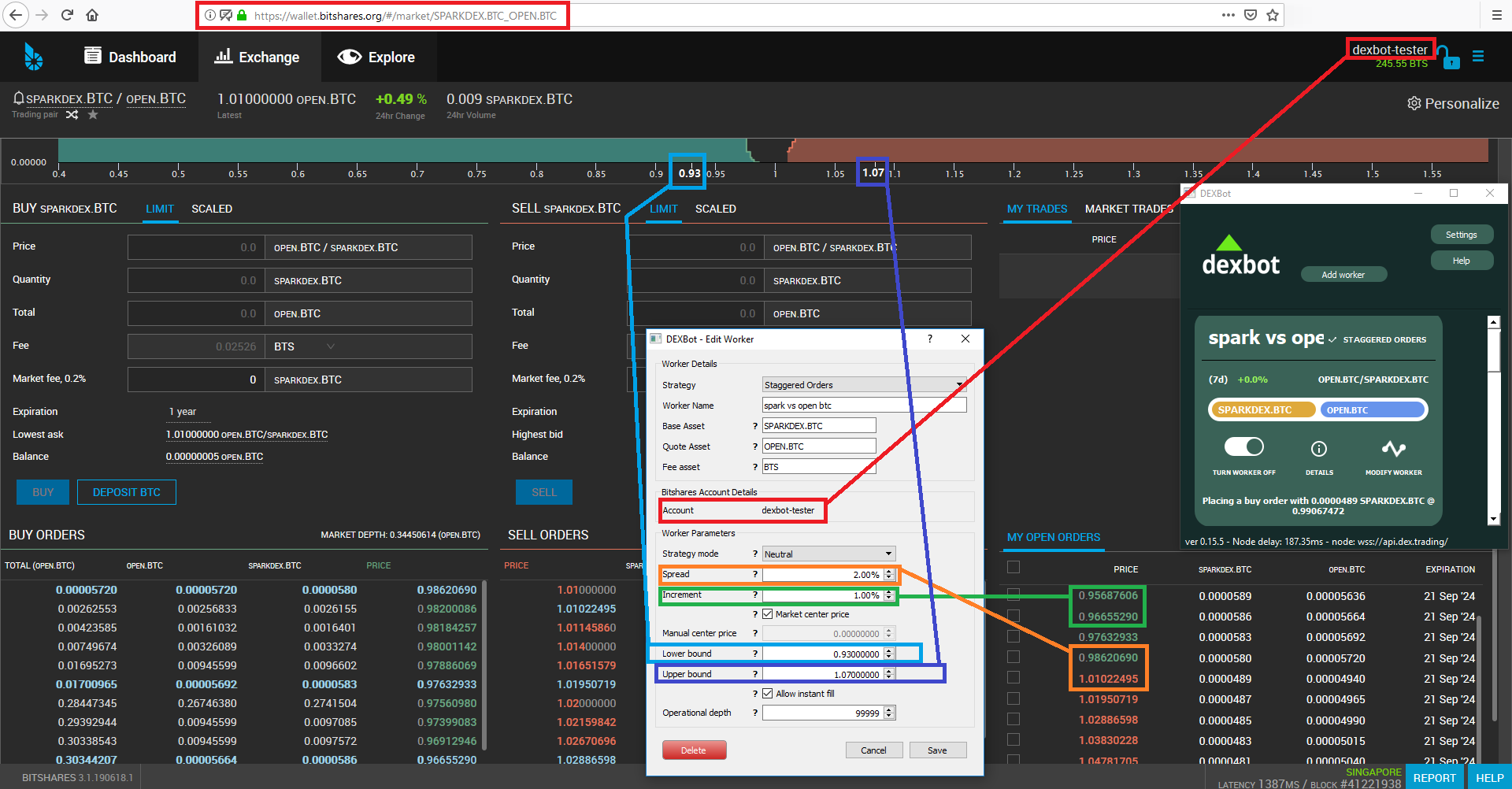

# "id": "1.3.861", "symbol": "OPEN.BTC",

# "id": "1.3.1570", "symbol": "BRIDGE.BTC",

# "id": "1.3.2241", "symbol": "GDEX.BTC",

# "id": "1.3.3926", "symbol": "RUDEX.BTC",

# "id": "1.3.4157", "symbol": "XBTSX.BTC",

# "id": "1.3.4198", "symbol": "SPARKDEX.BTC",

#

# "id": "1.3.1042", "symbol": "OPEN.USDT",

# "id": "1.3.5144", "symbol": "BRIDGE.USDT",

# "id": "1.3.5286", "symbol": "GDEX.USDT",

p2p-endpoint = 127.0.0.1:0

seed-nodes = []

trusted-node = 127.0.0.1:8090

#...

plugins = delayed_node

2. Run the Ruby script

https://github.com/abitmore/bts-mmcontest-scripts

to calculate rewards from the snapshot files.